Where C is the cash flow, t is the time to receipt of the cash flow, and P is the price of the bond. Graphically, Macaulay Duration is the point of balance (in years) for the cash flows from the bond (see below). This communication is provided for general information only, without regard to any specific objectives, financial situations and needs of any particular person. This communication does not constitute an offer or invitation to avail services modified duration vs macaulay duration and no part of it shall form the basis of or be relied upon in connection with any contract or commitment whatsoever. Nothing in this communication should be considered as an investment or financial advice, nor should this communication be construed as an advice to buy or sell or as a solicitation to buy or sell the securities if any referred to herein. They are, nevertheless, influenced by interest rate cycles depending on their duration.

This formula is used to determine the effect that a 100-basis-point (1%) change in interest rates will have on the price of a bond. The duration of a bond measures the sensitivity of the bond’s full price (including accrued interest) to changes in the bond’s yield-to-maturity or, more generally, changes in benchmark interest rates. This represents the bond discussed in the example below – two year maturity with a coupon of 20% and continuously compounded yield of 3.9605%. The circles represent the present value of the payments, with the coupon payments getting smaller the further in the future they are, and the final large payment including both the coupon payment and the final principal repayment. If these circles were put on a balance beam, the fulcrum (balanced center) of the beam would represent the weighted average distance (time to payment), which is 1.78 years in this case.

What is Modified Duration?

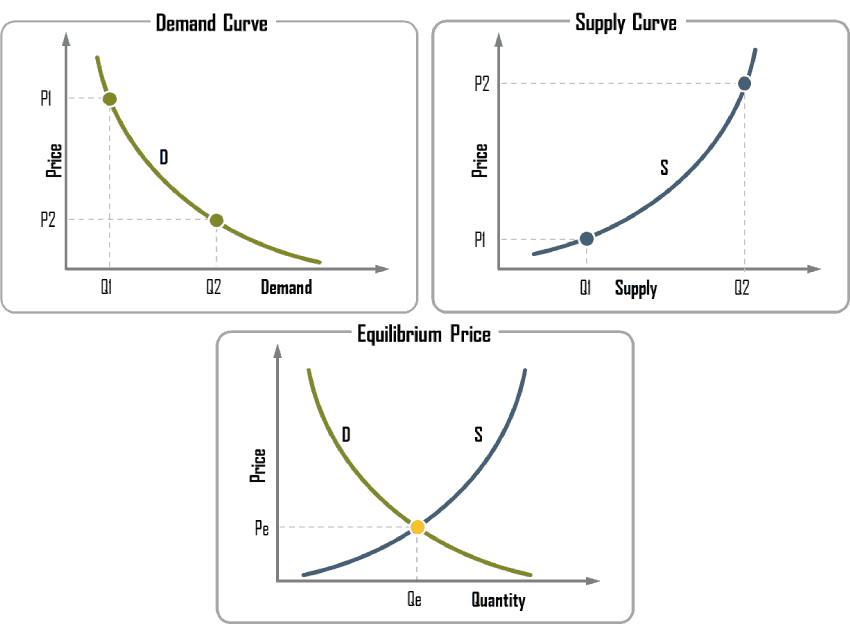

This bond’s price sensitivity to interest rate changes is different from a non-puttable bond with otherwise identical cash flows. In contrast, the modified duration identifies how much the duration changes for each percentage change in the yield while measuring how much a change in the interest rates impacts the price of a bond. Thus, the modified duration can provide a risk measure to bond investors by approximating how much the price of a bond could decline with an increase in interest rates.

- Another way to view it is, convexity is the first derivative of modified duration.

- Key rate durations require that we value an instrument off a yield curve and requires building a yield curve.

- Modified duration is a more useful measure for investors because it takes into account the bond’s yield to maturity.

- The yield curve is a graphical representation of the relationship between the yield (interest rate) and the maturity of a set of bonds or fixed-income securities with similar credit quality.

Modified duration evaluates how much a fund’s price varies as the interest rates or yield to maturity (YTM) change. This is the average time it takes for all securities in the fund to mature. If a debt fund’s average maturity is three years, all securities will mature in three years on average. However, if you check the maturity of each security, it may be different from three years.

Duration and Convexity

Breckinridge makes no assurances, warranties or representations that any strategies described herein will meet their investment objectives or incur any profits. Any index results shown are for illustrative purposes and do not represent the performance of any specific investment. They do not reflect any management, custody, transaction or other expenses, and generally assume reinvestment of dividends, income and capital gains. Performance of indices may be more or less volatile than any investment strategy. This material provides general and/or educational information and should not be construed as a solicitation or offer of Breckinridge services or products or as legal, tax or investment advice.

It provides valuable insights into a bond’s maturity, price sensitivity, and risk characteristics, helping investors make informed decisions about portfolio allocation, risk management, and yield curve positioning. [3] A bond’s yield to maturity is the discount rate that equates a bond’s price with the present value of the bond’s future payments. A bond’s duration, which is used to measure a bond’s sensitivity to interest rates, considers the timing of cash flows, providing a much better starting point to assess interest rate risk, relative to maturity. That said, while duration is an important concept for bond investors, we note that it is not a “one-and-done” solution for precisely capturing interest rate risk. This means that the bond’s weighted average time to maturity is 2.68 years. If interest rates were to increase by 1%, the bond’s price would decrease by approximately 2.68%.

Formula to Calculate Modified Duration

This is because the issuer can redeem the old bond at a high coupon and re-issue a new bond at a lower rate, thus providing the issuer with valuable optionality. Similar to the above, in these cases, it may be more correct to calculate an effective convexity. A bond with positive convexity will not have any call features – i.e. the issuer must redeem the bond at maturity – which means that as rates fall, both its duration and price will rise. Duration is commonly used in the portfolio and risk management of fixed-income instruments. Using interest rate forecasts, a portfolio manager can change a portfolio’s composition to align its duration with the expected level of interest rates. Duration is one of the fundamental characteristics of a fixed-income security (e.g., a bond) alongside maturity, yield, coupon, and call features.

Yield to Maturity vs. Holding Period Return: What’s the Difference? – Investopedia

Yield to Maturity vs. Holding Period Return: What’s the Difference?.

Posted: Sat, 25 Mar 2017 15:58:49 GMT [source]

Macaulay duration is a measure of the weighted average time it takes for an investor to receive the cash flows from a bond or a fixed-income security. It provides an estimate of the bond’s effective maturity or the point in time at which the bondholder can expect to receive the bond’s cash flows. Fixed income investments have varying degrees of credit risk, interest rate risk, default risk, and prepayment and extension risk. Income from municipal bonds can be declared taxable because of unfavorable changes in tax laws, adverse interpretations by the IRS or state tax authorities, or noncompliant conduct of a bond issuer. As an example, a $1,000 bond that can be redeemed by the holder at par at any time before the bond’s maturity (i.e. an American put option). No matter how high interest rates become, the price of the bond will never go below $1,000 (ignoring counterparty risk).

Why Duration Matters

The content is current as of the time of writing or as designated within the material. All information, including the opinions and views of Breckinridge, is subject to change without notice. Discover everything you need to know about Macaulay duration and modified duration, including how to calculate them and the distinctions between the two. This result shows that it takes 2.753 years to recoup the true cost of the bond. This shows that for every 1 percent movement in interest rates, the bond in this example would inversely move in price by 3.786 percent.

In summary, Macauley duration is a weighted average maturity of cash flows (measured in units of time) and is useful in portfolio immunization where a portfolio of bonds is used to fund a known liability. Modified duration is a price sensitivity measure and is the percentage change in price for a unit change in yield. Modified duration is more commonly used than Macauley duration and is a tool that provides an approximate measure of how a bond price will change given a modest change in yield.

The key difference between Macaulay duration and modified duration is that Macaulay duration measures the bond’s weighted average time to maturity, while modified duration measures the bond’s sensitivity to changes in interest rates. Modified duration is a more useful measure for investors because it takes into account the bond’s yield to maturity. The DV01 is analogous to the delta in derivative pricing (one of the “Greeks”) – it is the ratio of a price change in output (dollars) to unit change in input (a basis point of yield).

It’s important to note that bond prices and interest rates have an inverse relationship with each other. Modified duration is a measure of the price sensitivity of a bond portfolio to changes in interest rates. It quantifies the percentage change in the bond portfolio’s value for a 1% change in interest rates. Modified duration helps investors and portfolio managers assess the interest rate risk of their bond holdings and make informed decisions about portfolio management and risk mitigation strategies.

This shape indicates a market expectation of stable interest rates in the future. It can also signal a period of economic uncertainty or transition, where market participants are unsure about the direction of interest rates. Modified duration is a formula that expresses the measurable change in the value of a security in response to a change in interest rates. Modified duration follows the concept that interest rates and bond prices move in opposite directions.

All you wanted to know about Macaulay duration – BusinessLine

All you wanted to know about Macaulay duration.

Posted: Mon, 11 Jun 2018 07:00:00 GMT [source]

First, as maturity increases, duration increases and the bond becomes more volatile. Second, as a bond’s coupon increases, its duration decreases and the bond becomes less volatile. Third, as interest rates increase, duration decreases, and the bond’s sensitivity to further interest rate increases goes down. Effective duration of a bond is the sensitivity of the price of the bond to a change in a benchmark yield curve.

The previous percentage price change calculation was inaccurate because it failed to account for the convexity of the bond (the curvature in the above picture). An easy way to think of convexity is that convexity is the rate of change of duration with yield, and accounts for the fact that as the yield decreases, the slope of the price – yield curve, and duration, will increase. Similarly, as the yield increases, the slope of the curve will decrease, as will the duration.

Convexity

Modified Duration adjusted the formula2 for Macaulay Duration to create a new, important calculation. Macaulay duration and modified duration are two commonly used measures that can help investors determine how much a bond’s price will fluctuate when interest rates change. By calculating these measures, investors can make informed decisions about their bond investments and manage their portfolio risk effectively. Modified duration measures the average cash-weighted term to maturity of a bond.

To estimate the slope, we shift the yield-to-maturity up and down by the same amount, i.e., yield. The bond prices corresponding to the shifted yields to maturity are then noted. Mortgage-backed securities (pass-through mortgage principal prepayments) with US-style 15- or 30-year fixed-rate mortgages as collateral are examples of callable bonds.